Reluctant Markets Suck

Lessons Learned from Building Double

When a manager with a reputation for brilliance tackles a business with a reputation for bad economics, it is the reputation of the business that remains intact.

— Warren Buffett

What happens when you build a better product, charge nothing, and still can’t get people to switch? We found out the hard way with Double. We set out to democratize finance in 2023, built something we were genuinely proud of, and shipped it into a market that simply didn’t seem to care. Less than a year after launch, we shut it down.

Ignoring Good Advice

Early on, during YC’s retreat at the start of the W24 batch, I was chatting with Dalton Caldwell about Double. His feedback was characteristically direct: a lot of founders have ideas about better investing products. Consumers generally just don’t seem to care.

I listened. I nodded along. But I was hellbent on trying anyways. I thought I had an unlock, or at least a bunch of ideas to try. We were going to charge consumers nothing, while having a superior product that let users share their memable custom portfolios. I had specific ideas to break through the noise. When we launched, we hit the front page of Hacker News for 28 hours. We thought we had an unlock. But even that attention didn’t translate into the sustained growth we needed.

Dalton was right. We were wrong. Some lessons you have to learn yourself.

The Mission

I started Double after selling my last company. Yes, a cliché: make some money, start a company that revolves around managing that money. The idea was wealth managers and financial advisors have sophisticated tools (direct indexing, custom factor tilts, tax-loss harvesting across individual securities) that retail investors couldn’t access. These features were locked behind high account minimums and percentage-based fees.

I believed these tools should be available to everyone. That you shouldn’t have to pay the 1% AUM fee to access them.

Since we wouldn’t charge AUM fees, we had to chase scale: hundreds of millions to billions in AUM. The model relied on monetizing the float in customer accounts. Wealthfront makes ~75% of its $339M revenue this way, but float yields are measured in basis points, so scale was needed.

The Product

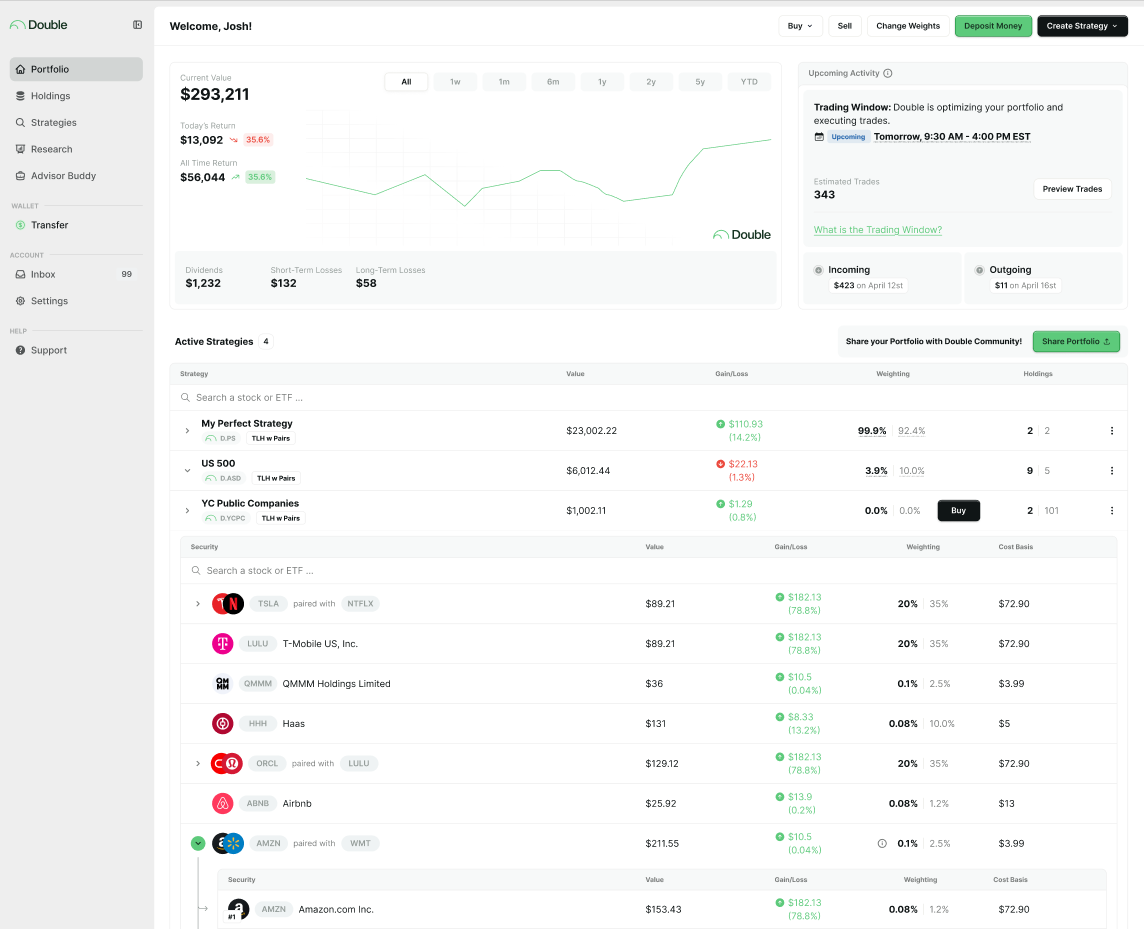

We built Double from scratch: a full‑stack investing platform that became an SEC‑registered RIA. It let anyone design custom portfolios with automatic daily rebalancing, tax‑loss harvesting, and recurring deposits.

By launch, users could build and backtest custom portfolios with recurring deposits that were automatically rebalanced and tax-loss harvested.

Each strategy had configurable rebalance modes. Want to tax-loss harvest between similar ETFs? Use pairs mode. Want to replicate the S&P 500 with individual stocks and swap losers for similar companies? Direct index mode. You could build a portfolio that’s 60% index-tilted tech, 30% dividend aristocrats, 10% meme stocks, all automatically rebalanced with tax-loss harvesting.

I’m particularly proud of the ability to dollar cost average between strategies on a set schedule over time. You could gradually shift from 100% stocks to 60% stocks over 12 months as you approached retirement, or slowly increase your tech tilt from 20% to 40% over 6 months without timing the market. It was powerful.

All of this was available with no AUM fee.

We assumed a $0 price tag, deeper control, and social hooks would move people off incumbents. But nobody really cared about that stuff.

Market Reality

After about 6 months, no matter how we looked at it, rapid, sustainable growth toward hundreds of millions of AUM seemed out of reach.

In our case, few users switched because of our features. Custom portfolios with tax‑loss harvesting and direct indexing didn’t drive acquisition, and people didn’t move money from Wealthfront or Vanguard just for customization. Zero AUM fees didn’t matter much either. Even eliminating fees entirely didn’t create urgency. Those who care are already at Vanguard, and everyone else values simplicity or trusted brands over saving basis points.

We were also late: Frec launched a year earlier, captured the Bogleheads with significant funding, and built something simple that people demonstrably wanted. Finally, our carrying costs were expensive. Real‑time market data along with historical price and fundamental data aren’t cheap. With Apex clearing and custody, our overhead hovered around $60k per month before any salaries, depressing our ability to iterate.

Lessons

There are a few lessons. A lot of them sound like generic startup advice but had to be learned the hard way. Be a painkiller not a vitamin. Consumer investing is a tough market because most people set a portfolio once and forget it. There is little urgency to switch.

Building for yourself can be a trap: I loved Double, but I’m a nerd about consumer finance and am willing to put up with some ACATS pain for monetary gain. I think of the Ben Horowitz quote “Nobody Cares”. That seemed especially true in this market.

And finally and most importantly, belief is the prerequisite. Mark and I stopped believing sometime in the spring. Once this happens, it all goes downhill quick. Protecting your belief is damn important.

Did We Quit Too Early?

Whenever I meet a successful CEO, I ask them how they did it. Mediocre CEOs point to their brilliant strategic moves or their intuitive business sense or a variety of other self-congratulatory explanations. Great CEOs tend to be markedly consistent in their answers. They all say, ‘I didn’t quit’

— Ben Horowitz

Did we quit too early? It’s very possible. You can’t know what didn’t happen.

Could we have pivoted to a more focused product? Absolutely. Maybe another year of grinding would have revealed the insight we were missing.

The problem was we weren’t playing where there was fast movement. Crypto and prediction markets (aka gambling) are the obvious places with real traction in consumer finance right now. We just weren’t excited about either.

But startups run on belief. Once you stop believing, the company is dead, even if the bank account isn’t. We had tried everything we set out to test. The data was clear: people weren’t switching. Grinding for another year hoping for a miracle wasn’t persistence; it was denial.

Instead, we decided to pivot and try to experiment with something else rather than run Double into the ground.

Robinhood made trading free. Wealthfront created the first robo-advisor. Frec and Composer are pushing the envelope right now. Someone will figure out what comes next. It won’t be us.

Gratitude

I’m grateful to my co-founder Mark Wai for being on this journey with me. To Vitali Zaharov, Matt Duffy, and David Harsha for their exceptional work building this product. And to Garry Tan, Ilya Sukhar, Jonathan Ehrlich, and the rest of our early investors for believing in us.

I’m particularly proud that I was able to build and open source Oracle, our portfolio optimization engine. It handles tax-loss harvesting via pairs or a factor model, direct indexing with custom ranges, and multi-strategy optimization. It was technically impressive work and I learned a lot about linear optimization. Unfortunately there isn’t a great place for consumers to implement direct indexing themselves using Oracle right now - primarily due to how brokerage APIs handle tax lot specification, which is needed for TLH.

What’s Next

I learned a lot, and we’re now working on Pillar. With agents set to dominate the web in five years, the definition of a website needs to change. Pillar is building better website search to make this a reality.

There are no perfect startup ideas, they all have warts before they start working. I’m grateful I get to try again.